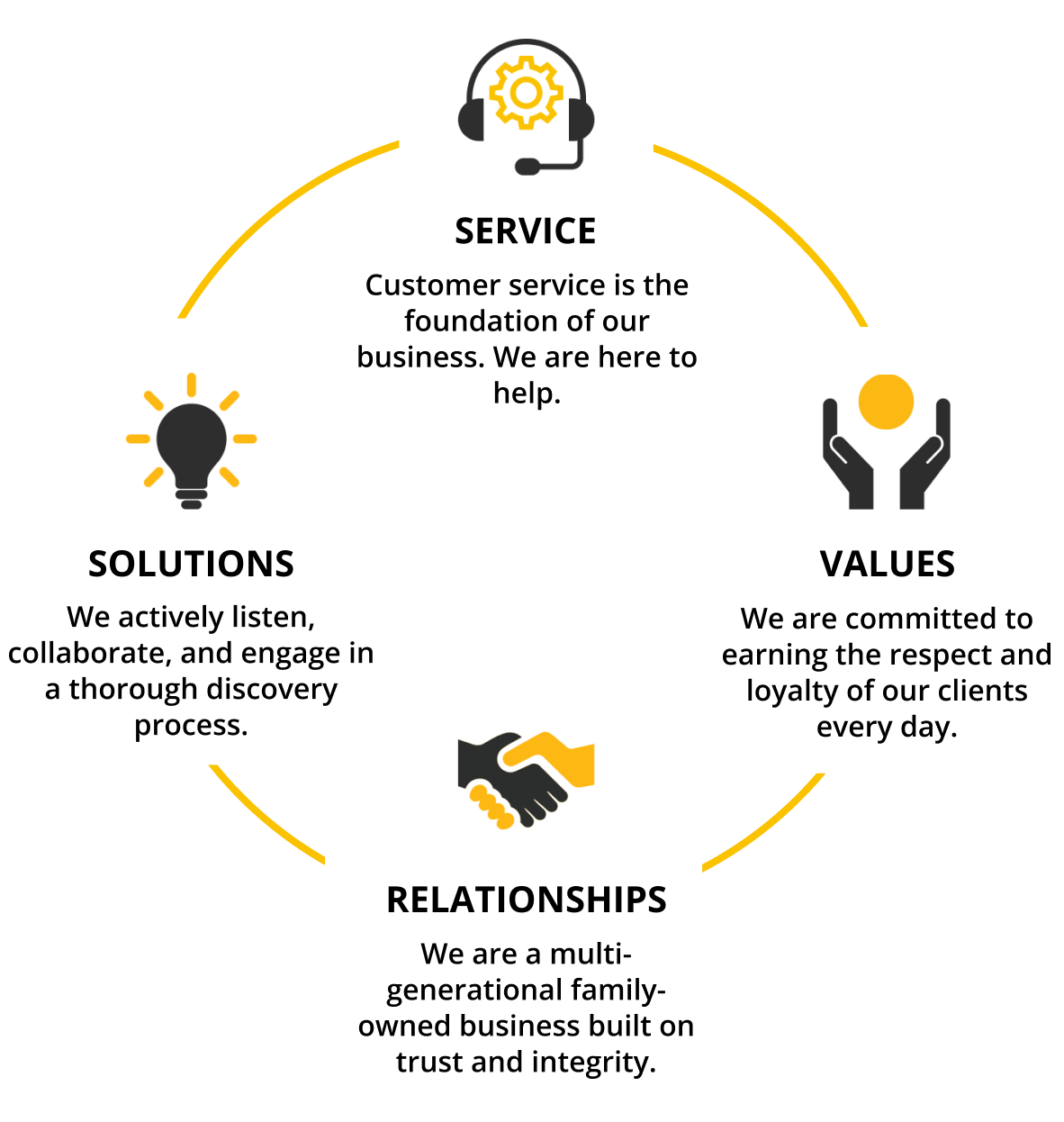

The Fedeli Group offers technical expertise, unmatched industry relationships and a desire to look beyond the obvious. We are curious, deliberate and thoughtful in helping you find solutions to protect assets, enhance employee retention and to drive business results.

Let’s Talk Strategy

Employee Life Cycle solutions that help you retain, attract and motivate talent.

Learn More

Identify, measure and manage risk in ways that address your risk tolerance and business strategies.

Learn More

Providing education and insight to individuals approaching 65 and employees approaching retirement.

Learn More

Through a focused-client engagement process that includes understanding your objectives, strict adherence to timelines, and goal setting, our professional and fully engaged staff is committed to delivering on our promises.

Learn Our Approach

40+ years in the business, take a walk through our history and learn more about our core values, our culture and our team.

Learn More About Us